St James’s Place (SJP) has announced that its updated charging structure will take effect on 26 August, accompanied by reductions in fund fees.

We first reported on the revised fee structure in October 24 and you can read more about that here https://claimmyloss.co.uk/st-

All SJP Pension & Investment Customers will be receiving a document containing tables providing a clear breakdown of the new fees and charges and how they compare to their previous charges.

What’s surprising on reading

Given the recent scandal surrounding SJP you might expect costs to be down across the board, however this isn’t necessarily the case.

Table 1 covers UK accounts and plans.

Biggest increase in costs +£27 per £10,000 per annum

Biggest reduction in costs -£12 per £10,000 per annum

Fund charges overall have increased by 0.09%, to remedy this SJP will be reducing their own Annual Management Charges by 0.09% to compensate clients for these increased costs.

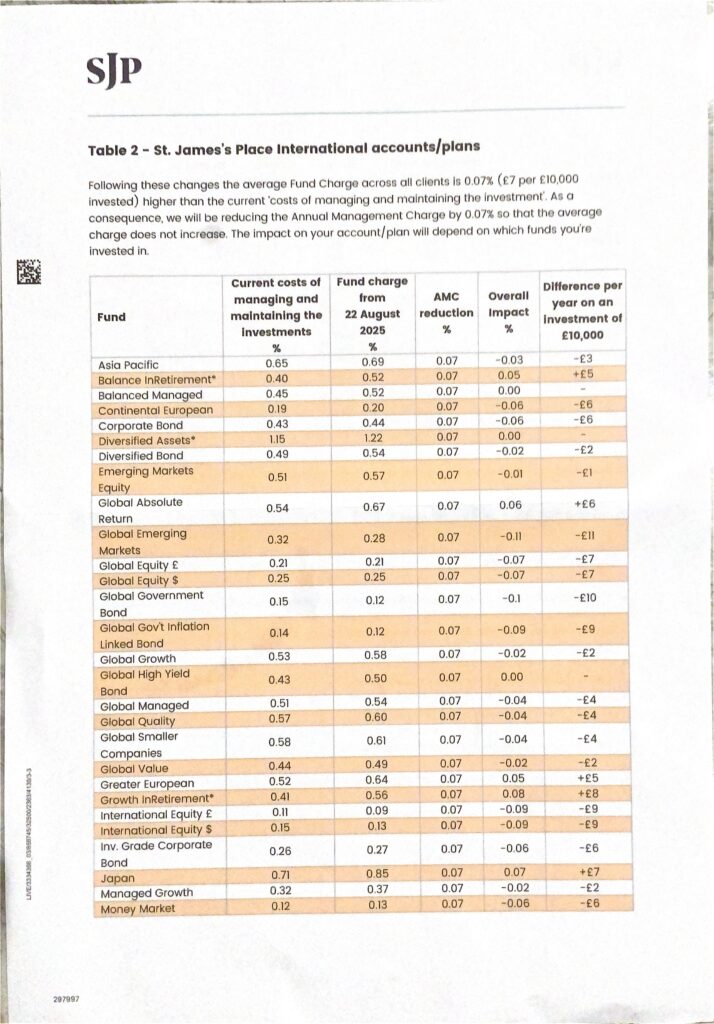

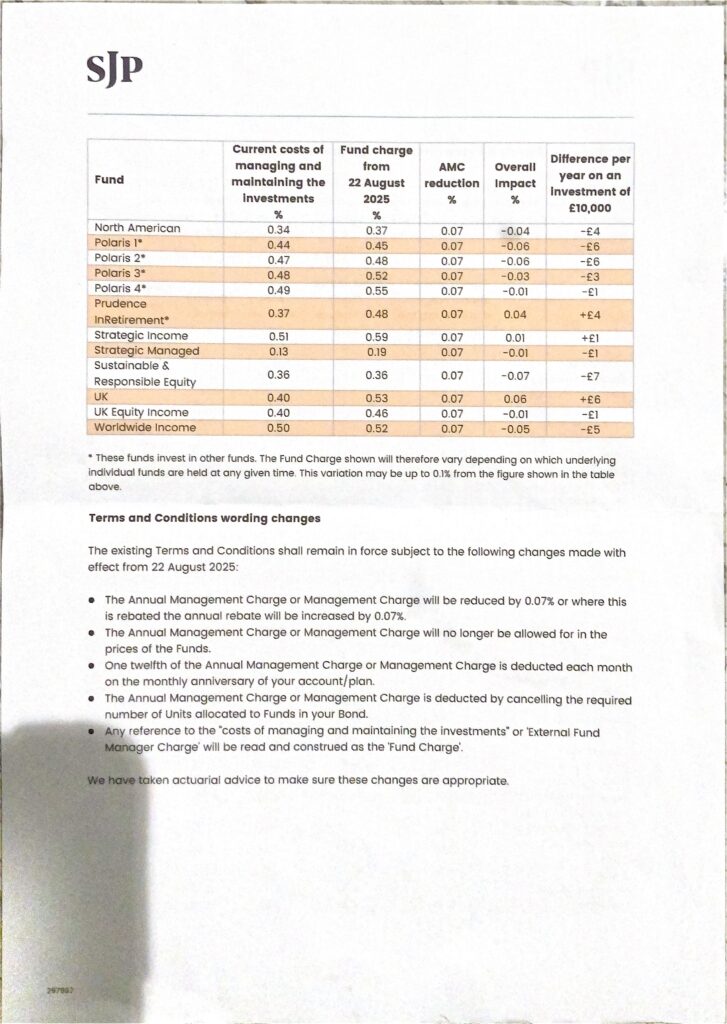

Table 2 covers SJP International Accounts & Plans

Biggest increase in costs +£8 per £10,000 per annum

Biggest reduction in costs -£11 per £10,000 per annum

Fund charges overall have increased by 0.07%, to remedy this SJP will be reducing their own Annual Management Charges by 0.07% to compensate clients for these increased costs as well

FT Adviser have also reported that the reforms will eliminate exit charges on pension and investment bond products, while introducing the unbundling of fees into distinct components for greater transparency.

Initial advice charges, previously capped at up to 4.5%, will now follow a tiered structure: 3% on the first £250,000 of invested funds, decreasing to 1% for amounts exceeding £500,000.

Ongoing advice fees will rise from 0.5% to 0.8%, with SJP introducing a share of advisers’ recurring fees for the first time. SJP has commenced notifying its one million clients of these adjustments.

In parallel, the wealth management firm today disclosed a review of its fund operating costs, leading to an overhaul of fund fees.

Effective from the same 26 August date, fund fees will be reduced ‘for most clients’, according to the group.

Details of the specific new fund fee levels have not yet been disclosed by SJP, (however a client kindly shares the documents which we have posted in the article) though as previously covered by news agencies, the firm has been methodically lowering charges across its fund offerings, particularly through transitions from active management to passive or systematic strategies.

This shift towards cost-effective passive investments is particularly evident in SJP’s Polaris range, which grew to £65bn in assets by April, less than three years after its inception.

SJP chief executive Mark FitzPatrick stated earlier this year that the new charging structure aims to address ‘the perception of SJP as being costly’.

Our Thoughts

It is no coincidence that since SJP put £430m aside to pay redress for their customers they have suddenly made huge improvements to their offering.

Their funds are performing well against industry benchmarks and will no doubt continue to do so under the new regime, however this does not mean that former clients and customer who have been with SJP for a number of years should not still be investigating whether they should be seeking financial redress.

The 430m that SJP put aside was specifically to refund annual management charges where advisers had charged annual fees but failed to carry out annual reviews.

THEY DO NOT automatically pay full redress for losses customers may have suffered specifically when convinced to transfer existing pensions or investments to SJP.

If you have been a customer of SJP within the last 12 years then we would advise you to investigate. If you aren’t comfortable making a complaint or simply don’t have the time, that is where we can help you.

After a brief conversation we carry out all of the investigations for you and handle your complaint from start to finish. If you have not been overcharged or lost money then it will not cost you anything and you will have peace of mind. However, if you do have grounds for complaint especially if you were mis-advised to transfer existing pensions or investment to SJP, then they have a responsibility to put you back into the position you would have been in had they never intervened and those claims can be thousands and thousands of pounds.

Do you have questions, why not book a 15 minute no obligation consultation with one of our SJP experts today.

Source – FT Adviser, St James’s Place New Fee Tariff’s